Privileged Access Management for Banks

Hundreds of financial institutions rely on Keeper to tightly control and monitor privileged access to critical systems and data, mitigating the risk of data breaches and unauthorised transactions.

KeeperPAM™ provides the most critical components of PAM unified in one scalable and cost-effective platform:

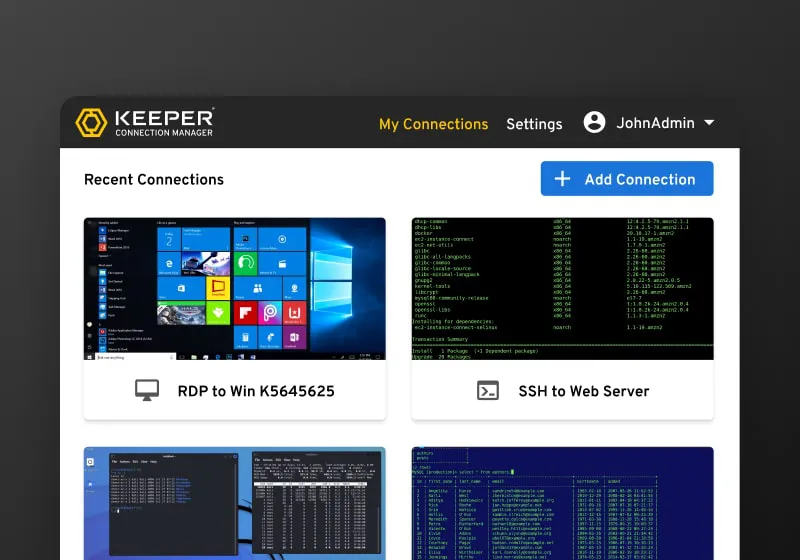

- Privileged Account and Session Management (PASM)

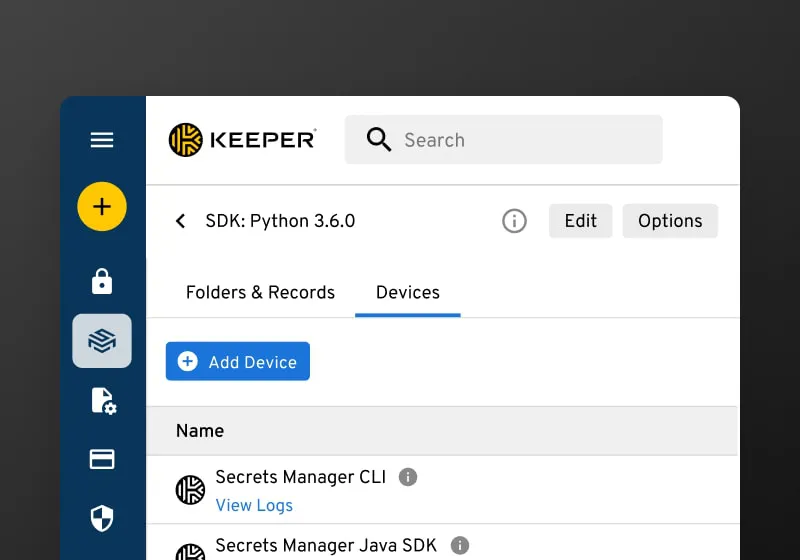

- Secrets Management

- Single Sign-On (SSO) integration

- Privileged Account Credential Management

- Credential vaulting and access control

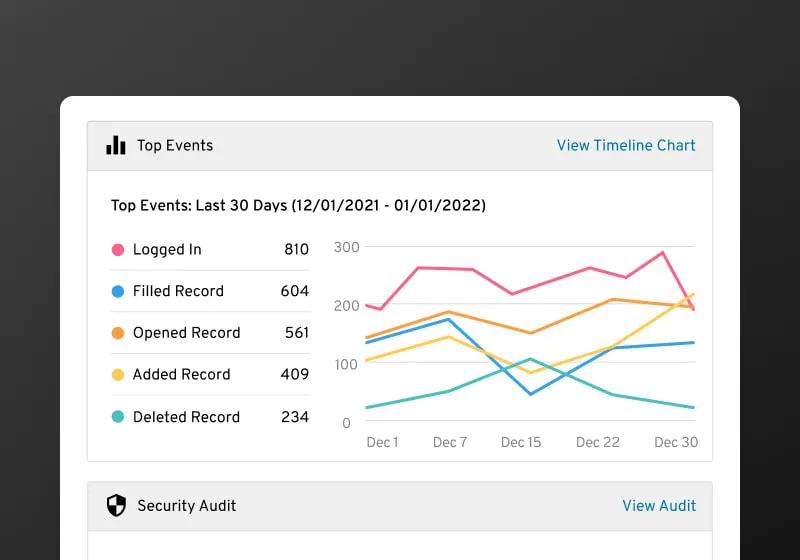

- Session management, monitoring and recording

- Privileged Elevation and Delegation Management (PEDM)