You can protect your digital footprint by deleting any accounts you no longer use, adjusting your privacy settings, avoiding oversharing on social media and using a

Some common Venmo business account scams include fake payment invoice scams, overpayment scams, fraudulent Venmo support, business impersonation scams and phishing scams. If you are unfamiliar with Venmo, it is a mobile app used to send and receive money, similar to PayPal, Zelle or Cash App. If you already have a personal profile on Venmo, you can create a business profile to keep track of your transactions and give you more payment methods, including the option to receive tips.

Keep reading to learn the five most common Venmo business account scams and how you can protect your business against Venmo scams.

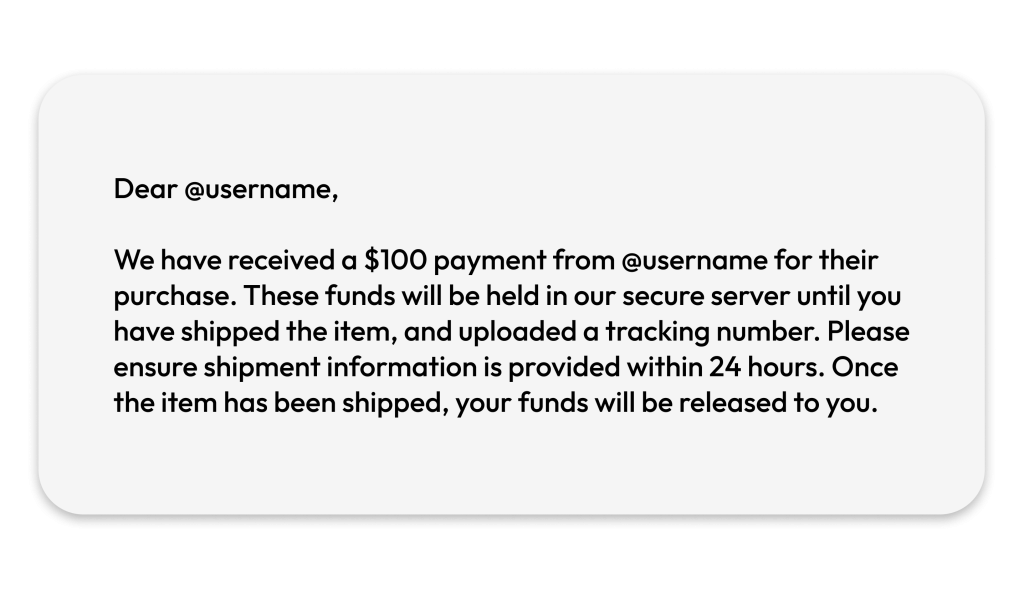

1. Fake payment invoice scam

When a fake payment invoice scam occurs, a scammer will pretend to be a real customer and send fake payments to businesses. You might receive an email from a customer with an illegitimate invoice confirming their purchase, and they will claim that Venmo is holding their payment for an item or service. However, Venmo cannot “hold” money in this way, and you should know that this tactic is what scammers do to try to get free items or services.

2. Overpayment scam

An overpayment scam is when a customer “accidentally” pays you more than an item is worth. You may be wondering how receiving more money than you asked for is a scam. This is because, if you refund the “extra” amount of money back to the customer, you will learn that their original payment was illegitimate. Overpayment scams are typically conducted with a stolen credit card, so the money you were paid is returned to the credit card owner and you’re out the “extra” amount as well as the item or service you provided the scammer. By refunding them the money you think they deserve, you lose out on your money because you never received the payment to begin with.

3. Scammers posing as Venmo support

A scammer might pretend to be a Venmo customer support agent or representative to trick you into sharing private information about yourself or your business. This scam relies on phishing, which is when cybercriminals manipulate their targets into revealing personal information like passwords or credit card numbers for financial gain. They could warn you that they’ve noticed unauthorized transactions on your account and that you need to verify your information to keep your business safe. However, a scammer could use the information that you give them to commit identity theft and is likely tricking you with the hope you will believe how urgent this matter is.

4. Business impersonation scam

As the name implies, a business impersonation scam involves a scammer making a Venmo account pretending to be a real business. By impersonating a business, a scammer can fool customers into sending them money for items that they will never receive since they are not a legitimate business. For example, if you have a business that sells flower pots and someone creates a Venmo account with your logo and near-identical information, someone might try to purchase flower pots from the illegitimate business instead of yours. This would cause a customer to lose their money and also not receive the item they desired.

5. Venmo phishing scam

Some scammers send emails impersonating Venmo and claiming that you need to click on a link to verify your information quickly. Be careful before clicking on any link that Venmo sends you, as it could be a phishing email instead of from the legitimate company. Check the sender’s email address; if it does not have @venmo.com at the end of it, that is a scam. Also, notice if the email contains grammatical and spelling errors or demands that you act quickly. Before clicking on any link from an email like this, copy and paste the link safely into Google Transparency Report which will check if the website is legitimate before you open the webpage. If you do not double-check the safety of a link and click on it, you could risk the fake website stealing private information such as financial details or your login credentials.

How to protect your business against Venmo scams

Despite the number of scams that could affect you and your business, there are several ways you can stay protected against Venmo scams.

Secure your business’s Venmo account

Keep your business’s Venmo account secure by using a strong password and enabling Two-Factor Authentication (2FA). You should use a password that consists of at least 16 characters and a combination of uppercase and lowercase letters, numbers and symbols. By using a random and unique password, you will make it more challenging for cybercriminals to guess and use your login credentials. After creating your strong password, you should enable Two-Factor Authentication (2FA) on your Venmo business account, which will require a user to know not only your username and password, but also provide an additional form of authentication to verify your identity. That way, if a cybercriminal did guess your password, your account could still not be accessed without the extra authentication method. 2FA is a type of Multi-Factor Authentication (MFA), which could be a PIN, an answer to a security question, your fingerprint, a facial ID scan or even your geographic location.

On your Venmo account, you can enable 2FA by going to Settings and selecting Face ID & PIN. You will then create a four-digit PIN and scan your face to enable 2FA on your Venmo account.

Verify transactions

Make sure all payments received are legitimate before you process a refund or ship your item to a customer. Unless a customer’s payment appears in your Venmo account, you should not solely rely on payment invoices because they could be part of a fake payment invoice scam. Check the notifications on your Venmo account, or download your transaction history on Venmo’s website.

Avoid clicking suspicious links

Be careful when a message contains a link, even if you think the message is coming from Venmo, because this could be part of a phishing attack. You can check to make sure a link is safe before clicking on it by hovering your mouse over it to preview the URL or pasting it into a URL checker. Do not click on any suspicious links that you receive through email or text, as these are most likely phishing and smishing attacks.

Never send overpaid money back

To prevent losing your own money in a transaction, never return “overpaid” money to a customer. This could be part of an overpayment scam, where a scammer sends you more money than an item costs and then asks for the “extra” back. Keep the money that the sender gave you, and inform the customer that they should discuss the situation with their bank to issue a refund. By doing this, you are protecting your money and testing the legitimacy of a customer’s purchase.

Contact Venmo customer service if something suspicious happens

You can protect your business account by immediately contacting Venmo support if anything suspicious occurs. When it comes to protecting your business, it’s better to be safe than sorry. Contact Venmo about suspicious messages or transactions. You can contact them by calling (855) 812-4430, chatting with a support agent or submitting a form on their website.

Keep your Venmo business account safe from scammers

Protect your Venmo account by being mindful of the variety of scams that could happen to your business. You can keep your Venmo business account safe from scammers by guarding it with a secure password and 2FA, verifying transactions, avoiding suspicious links and keeping any overpaid money. By following these best practices, your Venmo business account will remain more secure.