You can protect your digital footprint by deleting any accounts you no longer use, adjusting your privacy settings, avoiding oversharing on social media and using a

Yes, it is possible for someone to hack your Zelle account with your phone number if you use your phone number as a method of authentication for the Zelle app. This is possible due to a cyber threat known as a SIM-swapping attack. However, this shouldn’t be a cause for panic, as there are security measures you can take to prevent this from happening.

Continue reading to learn how it’s possible for someone to hack your Zelle with only your phone number and how to prevent your Zelle account from getting hacked.

What Is Zelle?

Zelle is a Peer-to-Peer (P2P) payment platform that enables users to send and receive money from friends and family. While Zelle has its own standalone app, Zelle also partners with banking institutions such as Bank of America and Chase to allow banking customers to send and receive payments using Zelle through their bank’s native app.

How Can Someone Hack Your Zelle With Your Phone Number?

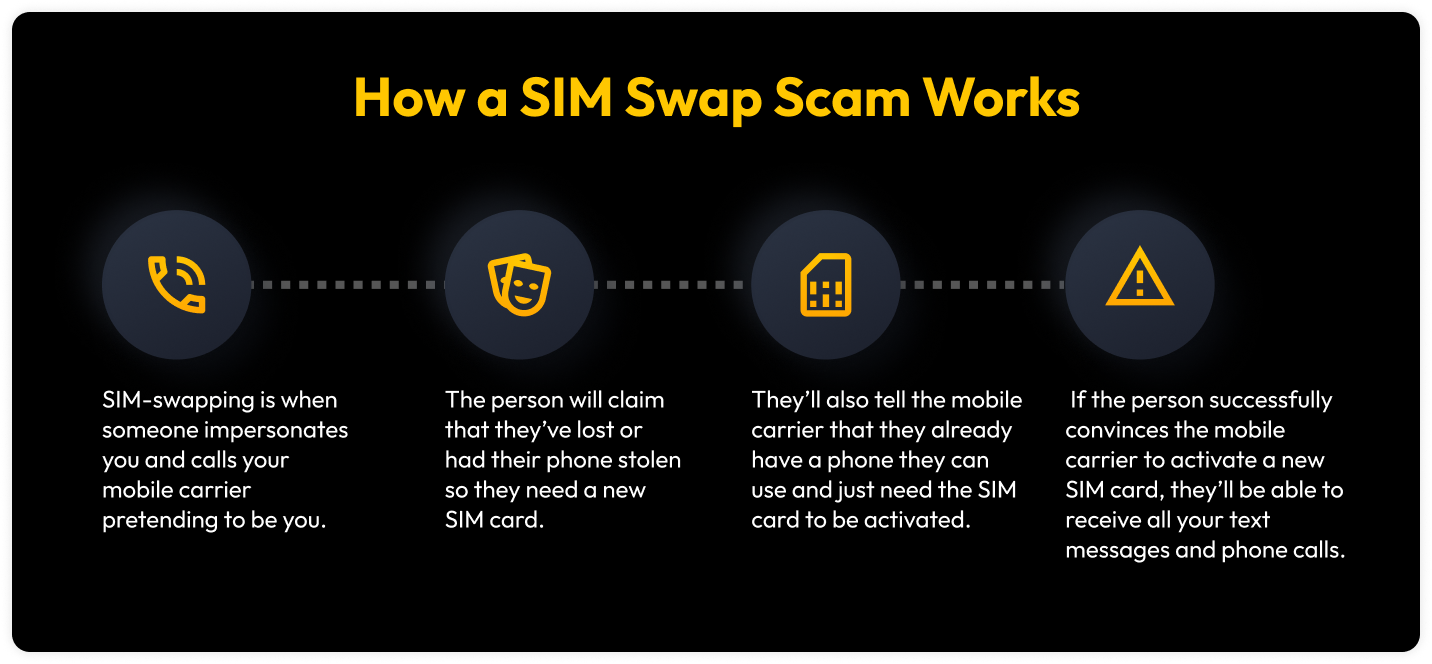

Someone can hack your Zelle account with your phone number using a cyber attack called SIM-swapping. SIM-swapping is when someone impersonates you and calls your mobile carrier pretending to be you. The person will claim that they’ve lost or had their phone stolen so they need a new SIM card. They’ll also tell the mobile carrier that they already have a phone they can use and just need the SIM card to be activated. If the person successfully convinces the mobile carrier to activate a new SIM card, they’ll be able to receive all your text messages and phone calls.

Not only will that person have the ability to hack into your Zelle account, but they would also be able to hack into other online accounts that have your phone number set up as a backup method of authentication. This is possible because when you forget the password for an online account, some accounts will ask you if you want a code or password reset link sent through text message or email. Most online accounts do this to authenticate your identity.

Once a threat actor starts receiving your phone calls and text messages, they’ll be able to receive all your password reset requests and SMS text codes – placing all your online accounts at risk of being hacked, including your Zelle account.

Other Ways Someone Can Hack Your Zelle

Your Zelle can also be hacked through a variety of other methods, including weak passwords, public data breaches and social engineering attacks.

Weak passwords

Weak passwords are passwords that don’t follow password best practices, so they’re easier for cybercriminals to crack or guess. Using weak passwords for any online account like your Zelle account places it at a higher risk of being hacked by cybercriminals. Weak passwords include passwords that contain common words and phrases, personal information and passwords that are reused across multiple accounts.

Public data breaches

Public data breaches happen often and can expose Personally Identifiable Information (PII) and login credentials. A public data breach is when a company you have an account or services with experiences a breach that results in customer and employee data being exposed. Cybercriminals take advantage of these public data breaches to gather as much exposed data as they can so they can sell it on the dark web or use it themselves to hack multiple user accounts for their own benefit. These public data breaches often result in stolen identities and financial losses for customers and employees.

Social engineering attacks

Social engineering is an attack that uses psychological manipulation techniques to convince unsuspecting victims to provide threat actors with their personal information. Oftentimes, threat actors will pretend to be someone the victim knows like a company they have an account with, a friend, a coworker or a family member. Once the threat actor has gained the victim’s trust, they’ll ask them to provide sensitive information like login credentials. If a victim falls for a social engineering attack by providing the threat actor with their username and password, the threat actor uses those credentials to hack into the victim’s online account.

A common tactic that many threat actors use to get a victim’s login credentials is via a spoofed website. Spoofed websites are sites that are created by cybercriminals to steal usernames and passwords. While these sites look legitimate, they’re not and any information you enter on them is immediately sent to the cybercriminal.

How To Prevent Someone From Hacking Your Zelle

Here are some of the steps you should take to prevent someone from hacking your Zelle.

Use a strong password for your Zelle account

Using a strong password is the first step you should take to better protect your Zelle account. Strong passwords are passwords that contain a random combination of letters, numbers and symbols and are at least 16 characters long. Coming up with strong passwords on your own is difficult, but using a password manager helps. Password managers help users create strong passwords for their accounts while also securely storing them so users don’t have to remember strong passwords for multiple online accounts.

While all your accounts should use strong passwords, it’s especially important to have strong passwords on financial accounts like your bank and payment applications.

Enable MFA on your Zelle account

Multi-Factor Authentication (MFA) is a security measure that requires users to provide one or more authentication methods in addition to their username and password. The more MFA methods you enable on your Zelle account, the better protected it will be against unauthorized users gaining access to your account.

While any MFA is better than no MFA, we strongly recommend not using SMS text codes as a form of authentication, if given the option. This will keep your account safe from SIM-swapping attacks.

Be on the lookout for social engineering attempts

Social engineering can be hard to spot, but it’s not impossible to stay protected against these types of attacks. Threat actors will often pose as Zelle so you’re more likely to provide them with the information they need to hack into your Zelle account.

Here are some red flags that point to social engineering.

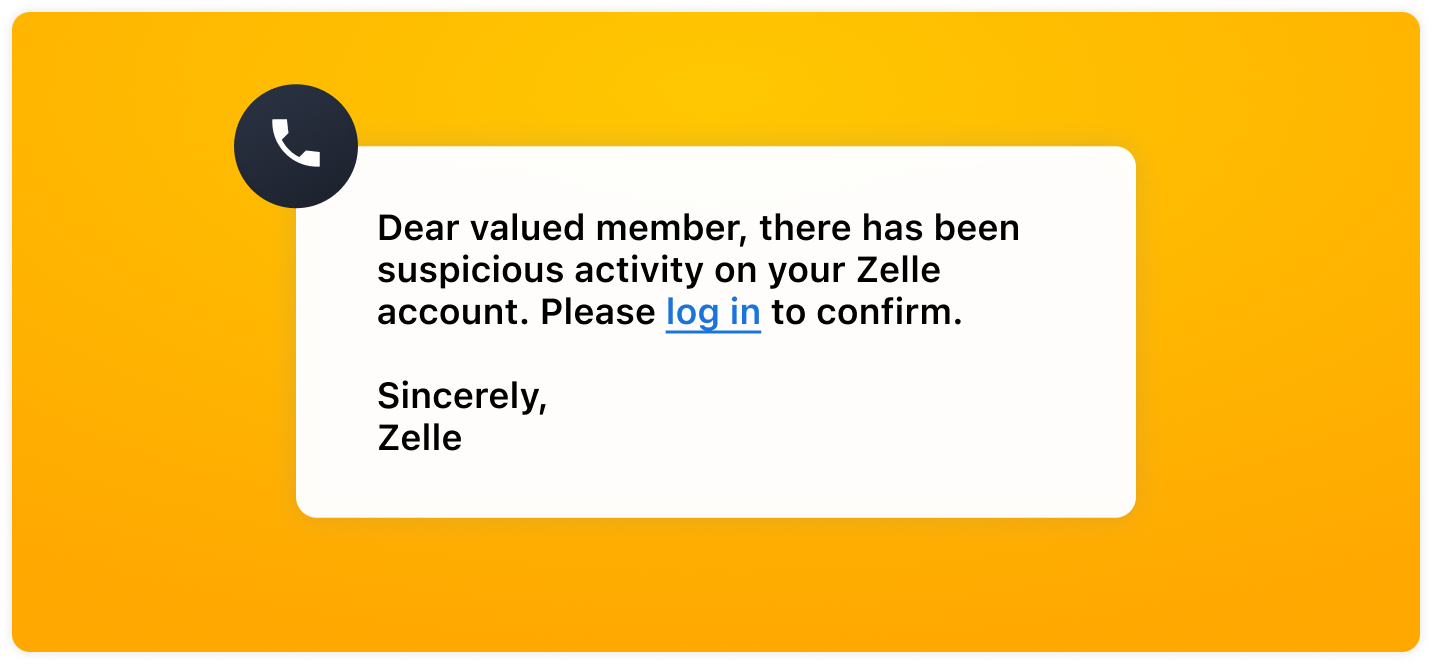

- Emails, text messages and phone calls urging you to provide sensitive information

- Example: A phone call from Zelle asking you to provide your login credentials.

- Being sent unsolicited links and attachments

- Example: An email from Zelle urging you to log in to your Zelle account using the link they’ve provided because of suspicious activity.

- Being threatened with serious consequences if you don’t do what you’re told

- Example: Being told that your Zelle account will be deactivated if you don’t provide them with your login information.

- An offer that seems too good to be true

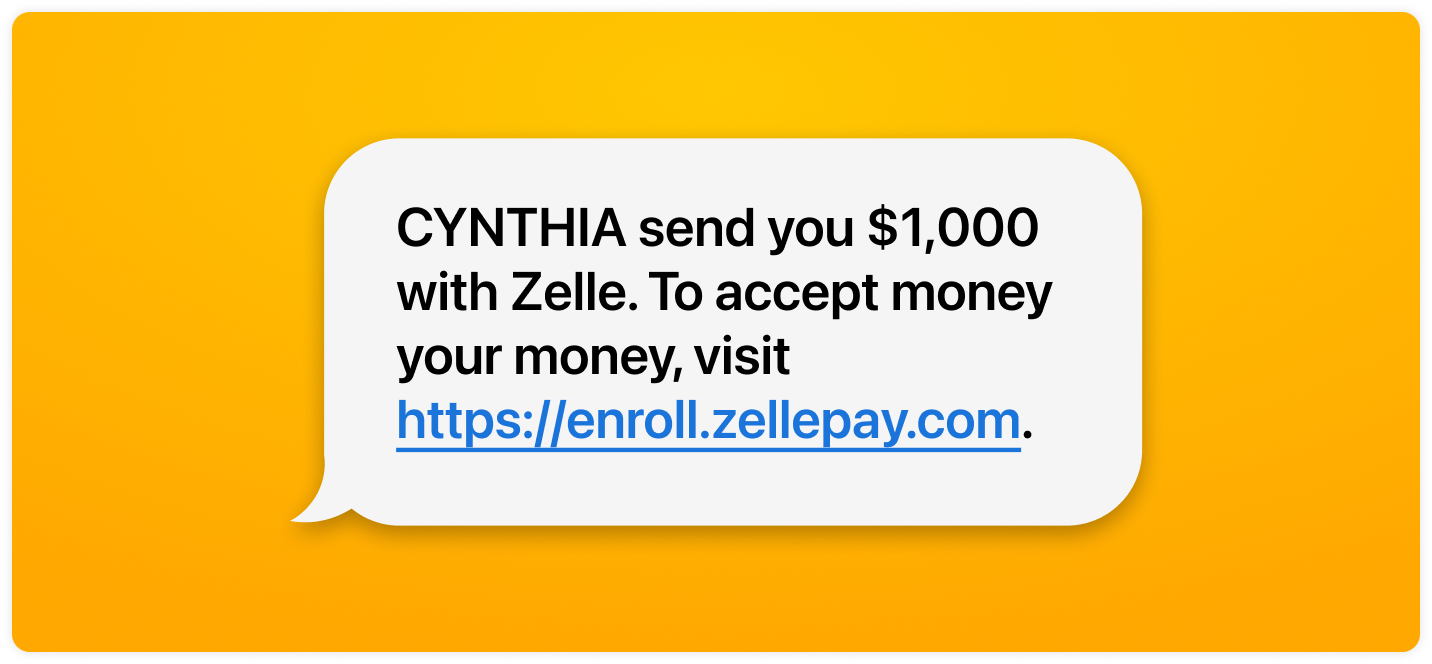

- Example: Receiving a text message from Zelle claiming that you’ve won money and all you need to do is click the link provided to receive the money.

Keep Your Zelle Account Safe From Hacking Attempts

With access to your Zelle, threat actors can drain your bank accounts. There’s no guarantee that you’ll get your money back, which is why you must take the necessary steps to secure your Zelle and other financial accounts.

A password manager like Keeper® can help keep your online accounts and applications safe from hacking attempts by creating strong passwords for you and enabling 2FA codes for each of your online accounts to keep them extra secure. To start securing your financial accounts and apps today, start a free 30-day trial of Keeper Password Manager.