Industry: Insurance

Protecting insurance providers with zero-trust privileged access management

KeeperPAM® helps insurers enforce least-privilege access, log activity across hybrid environments and stay audit-ready in a tightly regulated industry.

Industry: Insurance

KeeperPAM® helps insurers enforce least-privilege access, log activity across hybrid environments and stay audit-ready in a tightly regulated industry.

Of breaches in insurance companies involved third-party attack vectors

Of all cyber attacks targeted the finance and insurance sector, making it the second most attacked industry

Of cyber attacks in the insurance sector stemmed from phishing attachments in 2025

Insurance companies handle highly sensitive customer data, making insider threats a serious concern. Employees, contractors and internal teams often have privileged access to critical systems, and without proper oversight, this access can be misused, leading to data leaks or compliance violations.

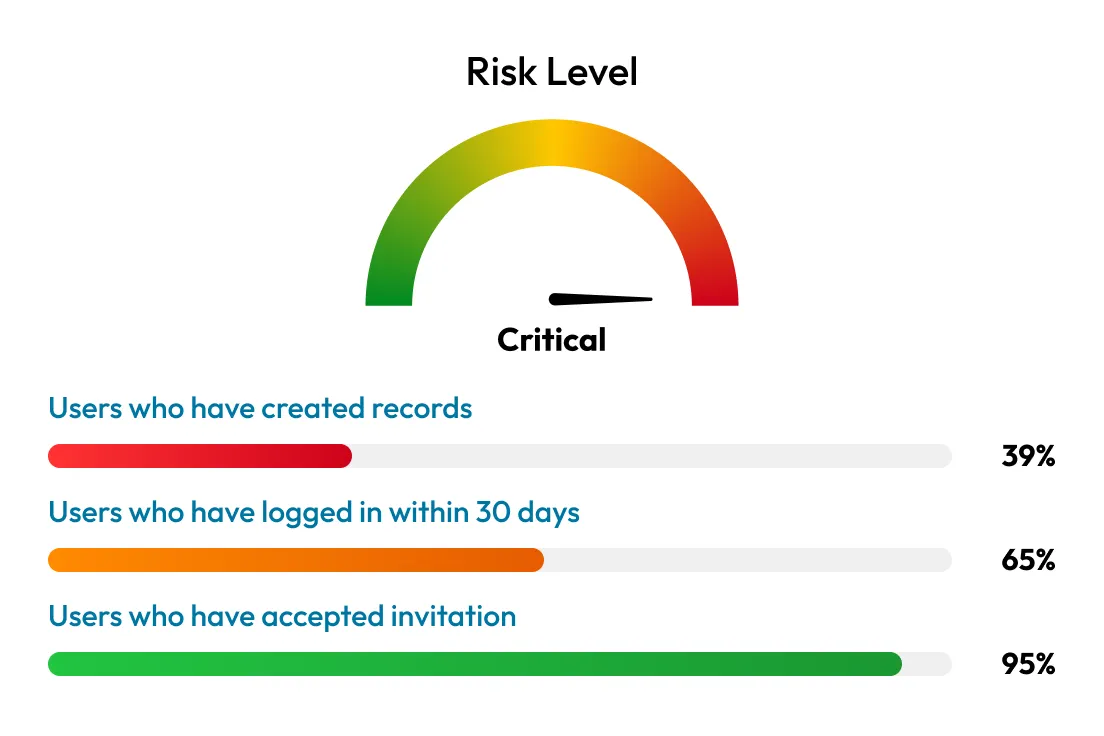

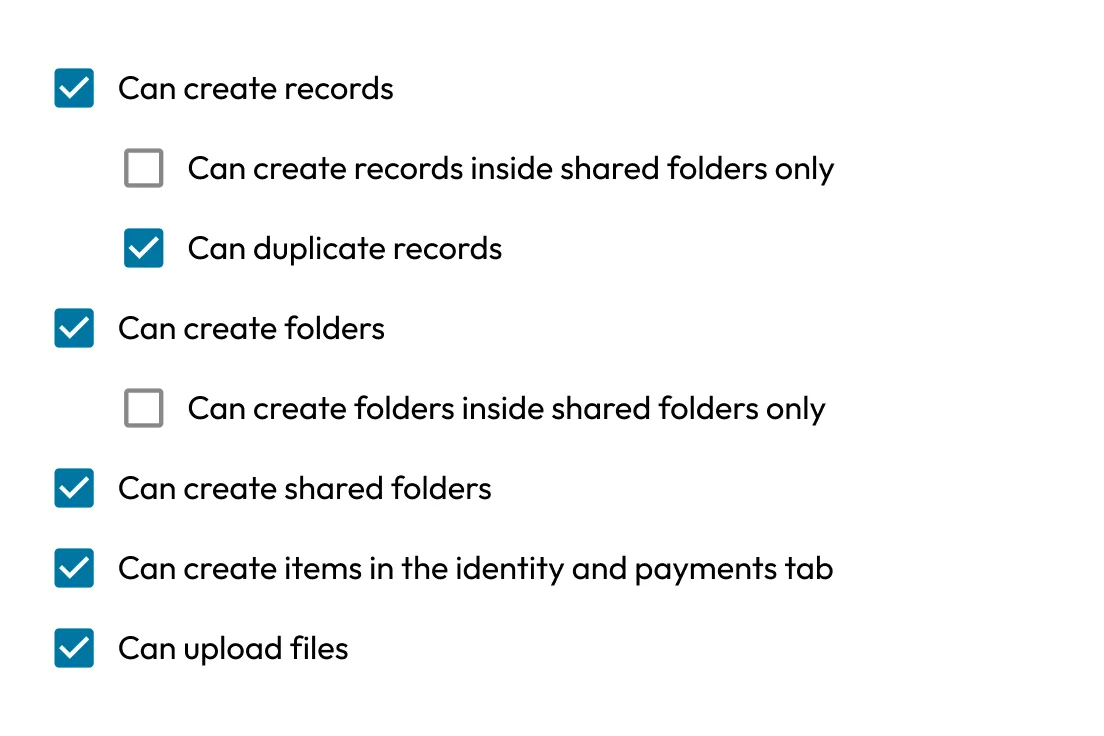

It's common in insurance environments for users to retain access rights they no longer need. Over time, this "privilege creep" creates unnecessary risk. Without regular access reviews and proper Role-Based Access Controls (RBAC), organisations face greater exposure to misuse, misconfiguration or account compromise.

Many insurance providers still rely on legacy infrastructure that lacks support for modern access control features. These systems are harder to secure, difficult to integrate with newer tools and often leave gaps in visibility and enforcement of privileged access policies, particularly across hybrid environments.

Agents, brokers, IT vendors and other third parties frequently need access to insurer systems. Managing their credentials, monitoring activity and limiting access to only what's necessary is challenging, especially without centralised oversight. Weak third-party access controls can lead to serious security and compliance risks.

As insurers adopt cloud technologies, managing privileged access across both on-prem and cloud systems becomes more complex. Each environment introduces its own risks, which makes consistent enforcement and visibility more difficult without unified tools.

Insurance companies are subject to strict regulatory oversight regarding access to sensitive data. Ensuring that privileged access is limited, monitored and auditable is important, but also resource-intensive without automation. Failing to meet requirements can lead to financial penalties and reputational damage.

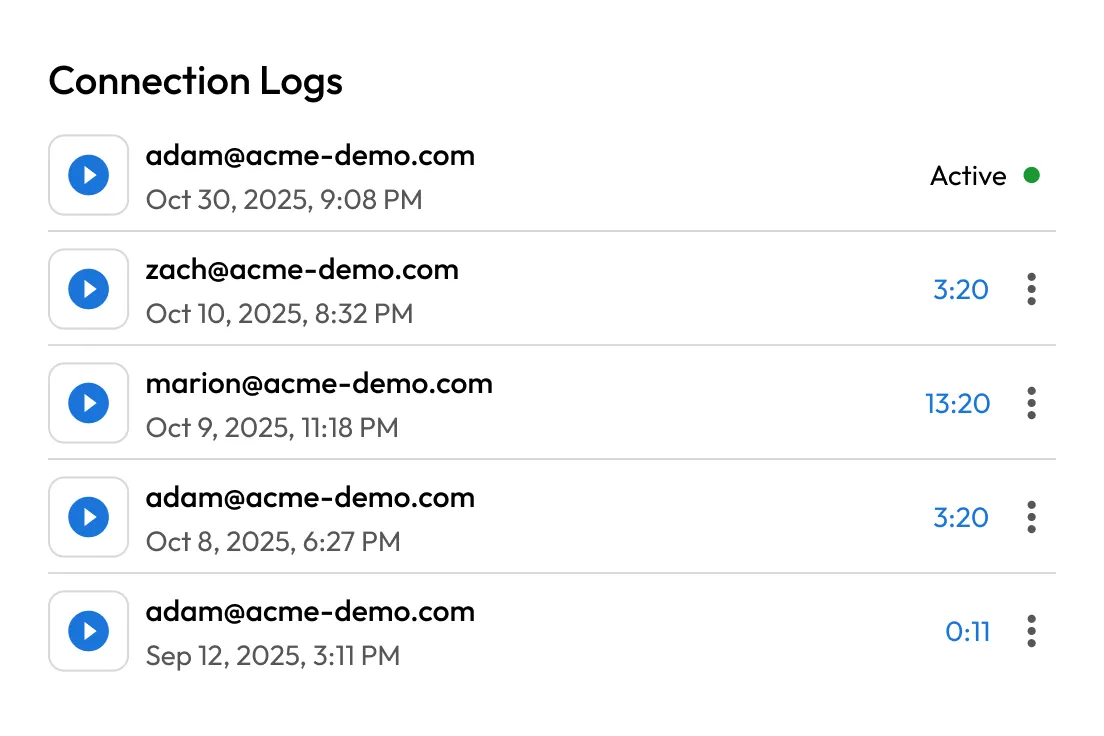

KeeperPAM reduces the risk of insider threats by continuously monitoring privileged sessions and capturing both screen activity and keystrokes. These detailed logs can be streamed to Security Information and Event Management (SIEM) tools for real-time threat detection or post-incident investigations. Role-based access controls restrict user permissions based on job roles, while the Admin Console provides full visibility into all privileged activity. Powered by KeeperAI, intelligent anomaly detection helps security teams identify suspicious behavior within privileged accounts, providing contextual alerts and enhancing threat detection capabilities across monitored sessions.

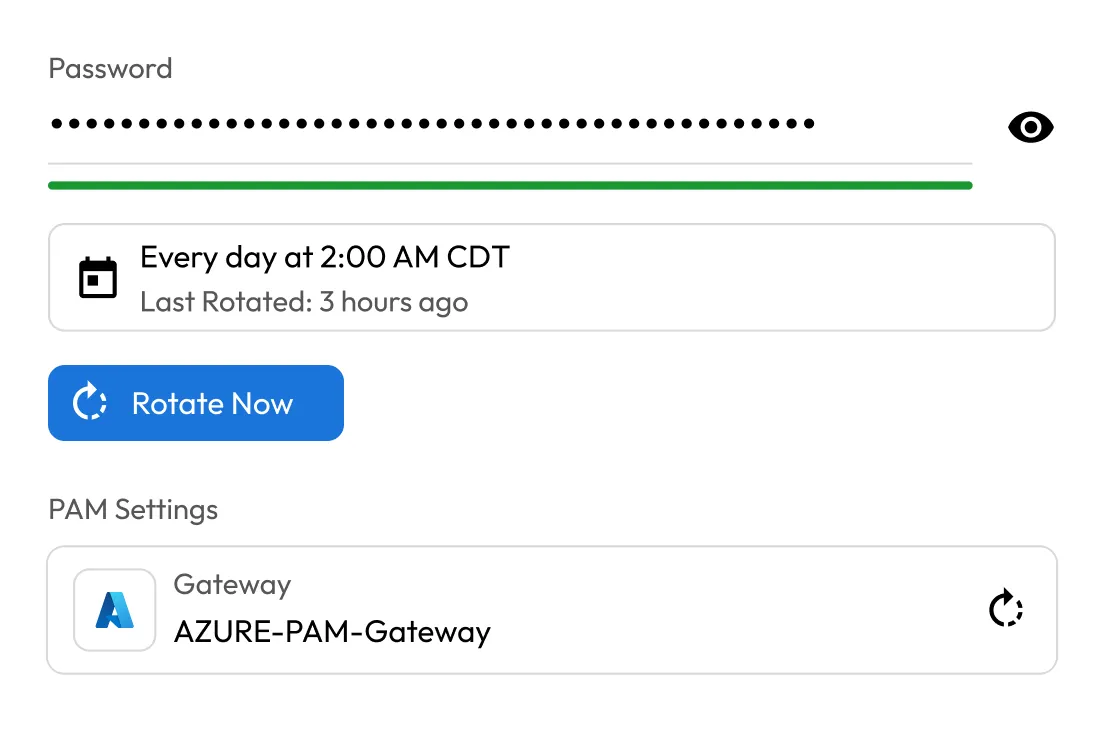

KeeperPAM strengthens access governance by enforcing strict role-based access controls and enabling Just-in-Time (JIT) access provisioning. Admins can dynamically grant and revoke access based on roles, time windows or workflows, and password rotation can be triggered automatically to eliminate standing privileges. With support for both cloud IAM and on-prem infrastructure, insurers can tightly control access to sensitive systems while reducing the risks associated with overprivileged accounts.

KeeperPAM secures legacy infrastructure without requiring software upgrades or local agents. By brokering credential-less, encrypted sessions through a zero-trust gateway, users can connect to legacy servers or databases using end-to-end encrypted tunnels. Admins maintain full control over access and can apply session monitoring, RBAC and rotation even in environments that don't natively support modern security controls.

Insurers rely on a broad ecosystem of third-party vendors, brokers and contractors, all of whom require varying degrees of system access. KeeperPAM lets organisations grant short-lived, credential-free access with tightly scoped permissions. All third-party activity is logged and recorded, and access can be revoked immediately after the task is complete. This minimises exposure without compromising operational flexibility and ensures full oversight of external user behavior.

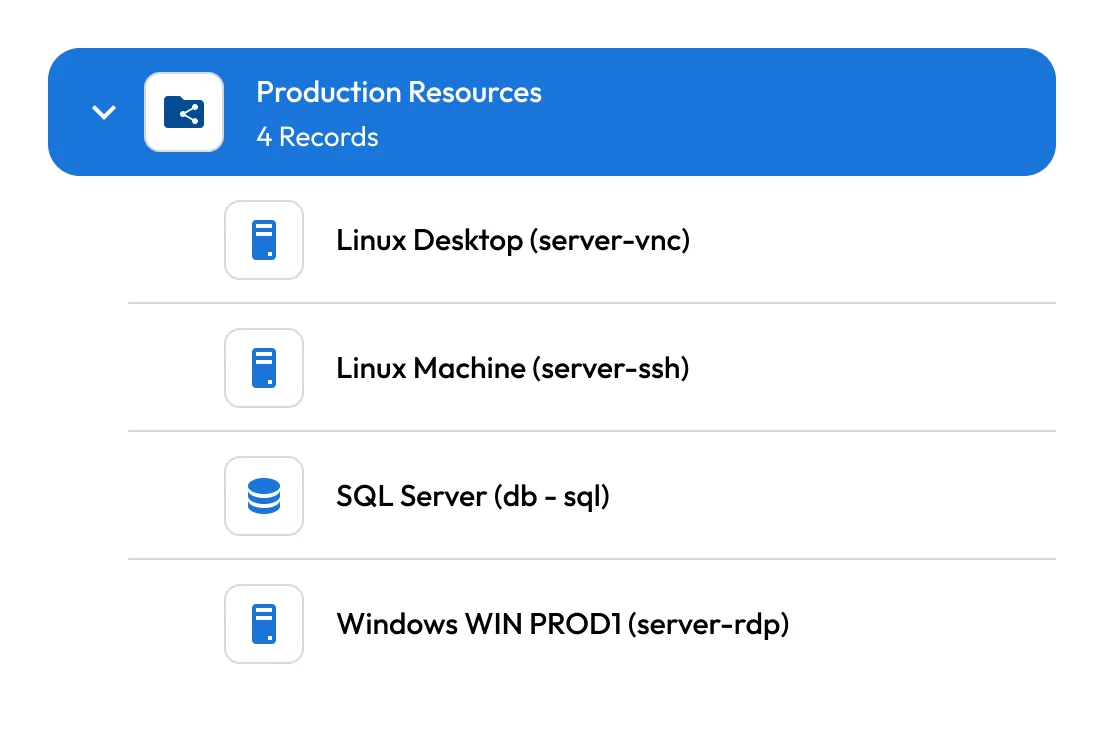

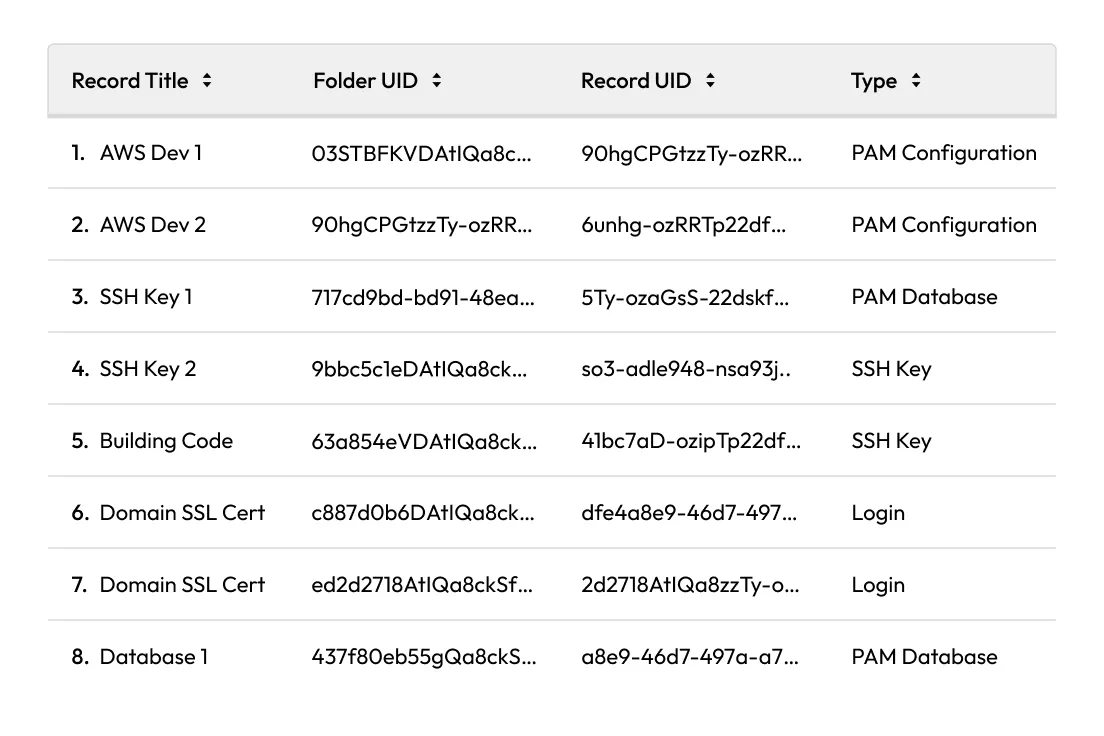

Managing access across cloud and on-premises environments can be complex and fragmented. KeeperPAM brings everything under one platform by supporting native protocols like SSH, RDP and SQL, and automatically discovering infrastructure and privileged accounts across your environment. Admins can onboard new systems quickly, apply consistent access policies and monitor all privileged sessions from a unified interface, regardless of where the asset lives.

KeeperPAM helps insurers meet stringent data protection requirements under HIPAA, GLBA, SOX and NYDFS by automating access controls, credential rotation and session logging. Every privileged action is auditable, and policies are enforced centrally. Reports can be generated instantly to support audits, reduce manual compliance overhead and prove adherence to industry regulations.

You must accept cookies to use Live Chat.